Overview

Cryptocurrency trading is in many ways similar to classic stock trading. Similar technical indicators, strategies and patterns of technical analysis. But at the same time, there are separate components of classical trading, which are much more important for trading on digital assets platforms. One such factor is the slippage crypto effect.

So what is slippage crypto? The sliding or slippage effect of the price is common in the stock markets, and it has become an especially important component of trading in the crypto market. The effect of sliding is that the execution of the order takes place at the most unfavorable price for the trader. For the most part, this is an unpleasant and most importantly unexpected moment in crypto assets trading.

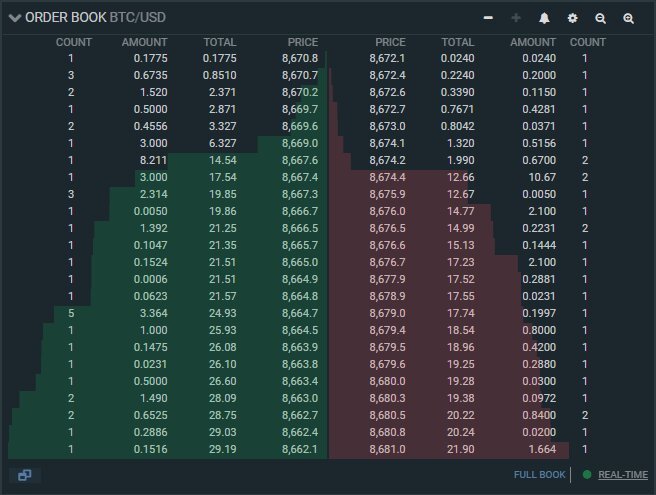

Typically, the sliding effect is applicable to markets with low or limited liquidity, as well as high levels of volatility. In such situations, the trader’s order will be executed at a different price than the one expected by the trader. Simply put, when creating an order or order, the exchange, first of all, looks at the general “trend”, which can be determined using the “order book”. Thanks to this, an acceptable price is chosen for the trader’s order, but if there are not enough volumes for it, then users will be in for an unpleasant surprise. The investor’s order will be executed at a different price, which, as a rule, is not profitable for the trader.

The changeability of the digital assets market is forcing investors to treat slipping with particular trepidation. Taking into account the influence of the background on digital currency quotes, one of the must-haves for a crypto trader is a constant analysis of the market and fundamental situation. After all, mutability and slippage depend on it.

Slippage is not always something negative. There is such a thing as positive slippage, and thanks to it, the trader gets the execution of the position in his favor. Positive slippage occurs when the price drops when a buy order is opened. And vice versa, when the price rises, but the trader opens a short position. Positive slippage is most common in highly volatile markets, but even there it is more of a rarity than a pattern.

Some crypto platforms have created a system for using slippage in the functionality of their platform. This allows you to set the allowable parameter manually and limit slippage. This feature is available on Ethereum and BNB Chain based DeFi platforms.

But this has its drawbacks, because if an investor uses such a function, it will negatively affect the speed of execution of his application. Perhaps this will prevent the user from getting the desired result. This usually happens when the slip level is too low. Otherwise, other players can use your position against you and achieve their goals faster.

The second and most common way to avoid slippage originates in the stock market. The use of various additional applications allows the dealer to establish a clear framework in which he acts. However, in such a situation, the speed of fulfillment of obligations also suffers, which can lead to a drop in income.

The slippage effect is an integral part of crypto trading. This influence cannot be completely excluded and in many cases it plays an important role in the final profit of the trader. Crypto assets are a very volatile instrument, and therefore the rate of change is high. Some see it as a negative, but it is also a great way to manipulate the market and price to achieve your own goals.